Besides Bitcoin, Ethereum, and Litecoin, there are over 10,000 types of cryptocurrencies on the market today. In its 2021 State of U.S. Crypto Report, the cryptocurrency exchange Gemini stated that 21.2 million U.S. adults (or 14% of the US population) currently own cryptocurrency and that another fifty million will invest in cryptocurrency within the next year. With statistics like these, it is clear that family law attorneys must be prepared to deal with one or more of the cryptocurrencies available today. How do family law attorneys determine if cryptocurrency is part of either spouse’s investment portfolio or how to value cryptocurrency, including any tax liabilities? As a family law attorney are you confident that you understand cryptocurrency well enough to advise clients when dividing this complex and volatile asset?

At Hoffman Divorce Strategies, we assist attorneys with community property divisions by addressing key areas pertaining to cryptocurrency: Discovery, Characterization, Valuation, Taxes, Strategic Allocation, and Mortgage Considerations. We can also review cryptocurrency holdings as part of a determination of income for purposes of spousal and child support.

Discovery

Unlike traditional investments, cryptocurrency wallets and platforms do not produce statements, and though transaction reports are available, they are difficult to read. A financial expert can review these statements, bank statements, income tax returns, and transactions in peer-to-peer payment platforms, such as Venmo, for forensic clues related to the existence of cryptocurrency.

Without a private key, cryptocurrency is difficult to trace and can be used to hide marital assets. To find out if cryptocurrency is owned by a client, attorneys should ask specific questions during discovery and direct examination when taking depositions.

Many cryptocurrency transactions take place on electronic devices, such as smart phones and laptops, so attorneys should decide whether to subpoena a spouse’s electronic device if there is a suspicion of undisclosed cryptocurrency holdings or trading. Subpoenaing electronic devices must be done in a timely manner, before transactions can be erased.

Characterization

Transaction reports help determine whether cryptocurrency was acquired by inheritance, gift, purchase, or barter in return for services, assisting counsel in determining the community or separate nature of the asset.

Valuation

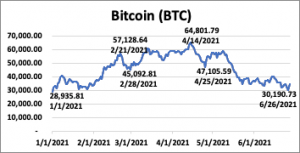

As shown in the chart below, cryptocurrency prices are extremely volatile, making valuation as close to trial or settlement as possible very important.

When settling a community that includes cryptocurrency it is important to consider the tax impact to each party. Internal Revenue Service (IRS) Notice 2014-21 considers virtual currency to be property for tax purposes and provides guidance on how to compute the basis and fair market value of virtual currency, as well as the calculation of gains and losses. Revenue Ruling 2019-24, addresses cryptocurrency transactions that create a taxable event. If cryptocurrency is transferred between spouses, it is important that the basis information of the asset transferred is exchanged. As many cryptocurrency exchanges did not report transactions on Form 1099, counsel may want to consider engaging an expert to review the transactions to make sure that all taxable events have been properly reported and there are no unpaid taxes.

Strategic Allocation

At Hoffman Divorce Strategies, we work with your clients to assess the impact of cryptocurrency on their settlement and advise them on strategies for division. We document these decisions to help protect counsel against a later claim from a client.

If your client elects to divide the cryptocurrency, you’ll need to determine if the holding spouse has an online or physical wallet. A private key, which can be requested during discovery, will be required to log in to the wallet. It is critically important to protect private keys – if they are lost or compromised in any way, access to the cryptocurrency could be lost and the asset becomes worthless.

To transfer cryptocurrency, the non-holding spouse will need to open an electronic wallet to receive his or her share of the cryptocurrency. The holding spouse can then send cryptocurrency from his or her wallet to the non-holding spouse’s wallet. A financial expert well-versed in the transfer of assets in divorce can assist with the transfer of cryptocurrency from one spouse to another.

Mortgage Considerations

Some mortgage lenders will consider cryptocurrency’s value when underwriting. However, mortgage lenders will not accept cryptocurrency as a form of down payment. If the client is going to use the value of cryptocurrency to purchase a property, counsel should be informed so that restraining orders do not prohibit the conversion of cryptocurrency into currency on a timely basis.

Hoffman Divorce Strategies works as part of a team with family law attorneys and their clients to prepare defensible financial reports for negotiation or litigation and with spouses to help them understand the quality and long-term financial impact of settlement proposals. We can help family law attorneys and their clients make better financial decisions and navigate the complexities of cryptocurrency. Contact us for more information.